(Bloomberg) -- Oil extended its slide from the lowest close in more than two years as investors wait for a Russian response to OPEC’s plan for deeper and longer cuts to offset the demand destruction caused by the coronavirus.

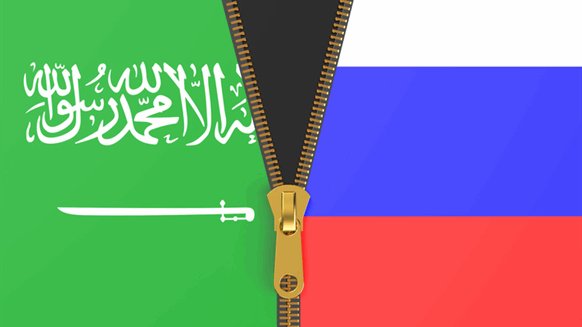

Brent closed below $50 for the first time since mid-2017 on Thursday after OPEC ministers tried to force Russia into accepting a proposal for a supply cut of 1.5 million barrels a day through to year-end. Cartel members warned that a failure to join may lead to the coalition abandoning curbs altogether. OPEC Secretary-General Mohammad Barkindo struck a more conciliatory tone and said there is no reason to doubt Russia’s commitment to the alliance.

Oil has whipsawed this week as the world’s biggest exporters haggled over their response to the outbreak that is threatening to shrink crude demand for only the fourth time in almost 40 years. The virus has forced the world’s largest economies to cobble together stimulus packages and cut lending rates to try and offset the impact from reduced industrial activity and travel.

“OPEC+ has been completely caught with its pants down” after not acting sooner due to Russian opposition, said Jeffrey Halley, a senior market analyst at Oanda. “Now they are actually playing catch up. If the coronavirus situation gets worse, OPEC+ will have to cut again.”

Brent for May settlement fell 50 cents, or 1%, to $49.49 a barrel on the ICE Futures Europe exchange as of 7:33 a.m. in London after rising as much as 0.9% earlier. The contract dropped 2.2% to settle at $49.99 on Thursday and is down 2% for the week.

West Texas Intermediate futures for April delivery lost 46 cents, or 1%, to $45.44 a barrel on the New York Mercantile Exchange. The U.S. crude benchmark ended 1.9% lower on Thursday and is up 1.5% this week.

Russia’s oil minister Alexander Novak will return to Vienna on Friday for a crunch round of talks after flying back to Moscow on Wednesday to consult with the Kremlin. The current version of the OPEC proposal calls for the cartel to cut 1 million barrels a day of its production, contingent that non-OPEC nations led by Russia reduce their output by 500,000 barrels a day.

The standoff is the biggest crisis since the alliance, controlling more than half of the world’s oil production, was formed in 2016. So far, Russia has indicated it doesn’t want to go deeper on cuts but is prepared to roll over the current cuts for another three months.

“It’s a negotiating ploy by Russia,” Halley said. “They just want to ensure that their part of the cut is as small as possible.”

--With assistance from James Thornhill.

To contact the reporter on this story:

Saket Sundria in Singapore at ssundria@bloomberg.net

To contact the editors responsible for this story:

Serene Cheong at scheong20@bloomberg.net

Ben Sharples, Andrew Janes

No comments:

Post a Comment