(The views and opinions expressed in this article are those of the attributed sources and do not necessarily reflect the position of Rigzone or the author.)

Last week, Rigzone ran a Bloomberg article asserting that “cheaper drilling costs may not be sufficient to help shale recover from a pandemic-induced slump.” A regular Rigzone market-watcher advises caution regarding such claims. Keep reading to find out why, along with other projections.

Tom McNulty, Houston-based Principal and Energy Practice leader with Valuescope, Inc.: I continue to expect U.S. production to increase. Be wary of public commentary on break-even oil prices. I have several clients that can make anywhere from $7 to $15 per barrel at these prices. Upstream players who cannot are not running their operations properly.

Mark Le Dain, vice president of strategy with the oil and gas data firm Validere: A close watch on production for the next couple months will be the major focus as this is when the lack of spending post-COVID will really start to show up.

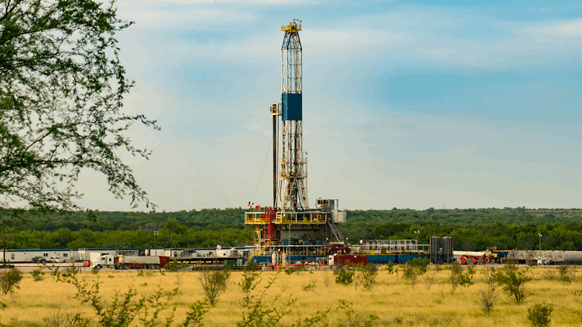

Phil Kangas, US Partner-in-Charge, Energy Advisory, Natural Resources and Mining, Grant Thornton LLP: Baker Hughes (NYSE: BKR) reported rig counts continue to rise, with an additional 10 coming online (as of Nov. 25; the Dec. 4 count appears here). As crude prices continue to fluctuate in a dynamic environment, we will be watching to see how such factors as OPEC+ production decisions, a resurgence of COVID-19 after a heavily traveled Thanksgiving holiday and weekly U.S. Department of Energy supply draws further drive or hinder crude prices to reaching the point of profitable production. In a survey from early this spring, the Dallas Federal Reserve had reported profitable production return on investment occurs in the $46 to $52 range for most exploration and production firms operating in the United States. If WTI prices begin to approach this range, it will be interesting to see the effect on rig count and Energy Information Administration volume draws.

Andrew Goldstein, President, Atlas Commodities LLC: OPEC announced an increase to their collective output by 500,000 barrels per day (bpd) starting in Jan. 2021. The agreement was a compromise between countries that wanted an increase of 2 million bpd. I would look for there to be some ambivalence in the WTI market as traders have a tough time deciding what the slight increase will mean.

Barani Krishnan, Senior Commodities Analyst, Investing.com: Whether diesel demand drops further. That could offset some of the market’s hyper-bullishness now.

To contact the author, email mveazey@rigzone.com.

No comments:

Post a Comment