Energy Transfer LP (NYSE: ET) will acquire Enable Midstream Partners, LP (NYSE: ENBL) in an all-equity transaction valued at approximately $7.2 billion, ET reported Wednesday.

Acquiring Enable will strengthen ET’s natural gas liquids (NGL) infrastructure by adding gas gathering and processing assets in the Anadarko Basin in Oklahoma and integrate with ET’s U.S. Gulf Coast NGL transportation and fractionation assets, ET pointed out in a written statement. Moreover, Dallas-based ET noted out that it will gain significant gas gathering and processing assets in the Arkoma basin in Oklahoma and Arkansas as well as the Haynesville Shale in East Texas and North Louisiana.

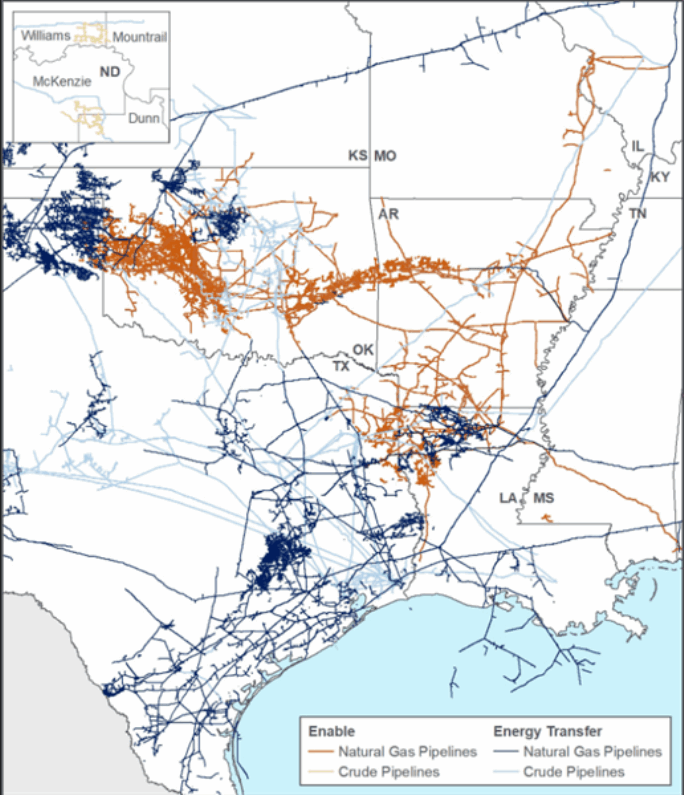

Enable and Energy Transfer's pipelines. IMAGE SOURCE: Business Wire

Enable and Energy Transfer's pipelines. IMAGE SOURCE: Business Wire

“Energy Transfer expects the combined company to generate more than $100 million of annual run-rate cost and efficiency synergies, excluding potential financial and commercial synergies,” stated ET.

Under the terms of the companies’ definitive merger agreement, Enable common unitholders will receive 0.8595 ET common units for each Enable common unit, ET stated. The transaction, which has won approval from both companies’ boards as well as ET’s conflicts committee, would also exchange each outstanding Enable Series A preferred unit for 0.0265 Series G preferred units of ET and pay $10 million in cash to Enable’s general partner, the firm noted. Enable unitholders will own approximately 12 percent of ET’s outstanding common units, added ET

“Enable’s transportation and storage assets enhance Energy Transfer’s access to core markets with consistent sources of demand and bolster its portfolio of customers anchored by large, investment-grade customers with firm, long-term contracts,” ET stated. “Energy Transfer will further enhance its connectivity to the global LNG market and the growing global demand for natural gas as the world transitions to cleaner power and fuel sources.”

ET did not specify when the acquisition will close, but a company spokesperson gave Rigzone some idea of a time frame.

“We have not said anything beyond mid-2021 at this time,” the spokesperson commented.

To contact the author, email mveazey@rigzone.com.

No comments:

Post a Comment