Texas’ upstream oil and gas economy suffered a 30-percent contraction in 2020, the Texas Alliance of Energy Producers reported Monday, citing its Texas Petro Index (TPI).

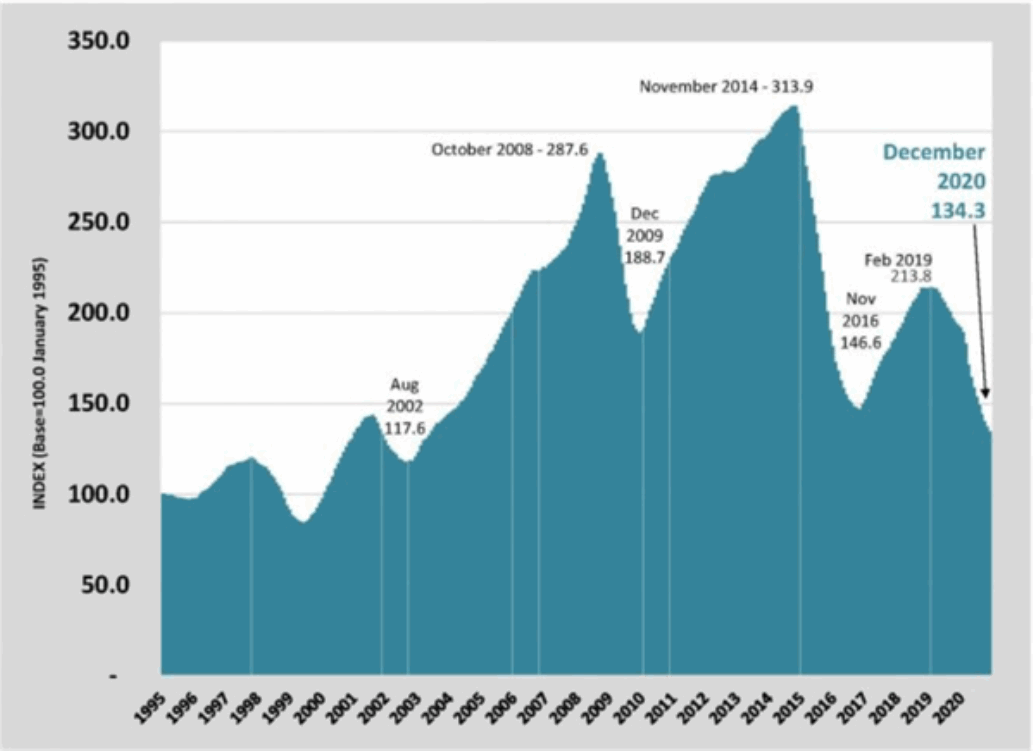

Created by Karr Ingham, petroleum economist for the Alliance, the TPI measures the cyclical health and vitality of Texas’ oil and natural gas economy. According to an Alliance written statement emailed to Rigzone, the TPI posted its 22nd straight month of decline in Dec. 2020 – falling to 134.3 from 137.0 the previous month. In Dec. 2019, the TPI registered at 193.2 – 30.5 percent higher than the Dec. 2020 figure.

The Alliance pointed out the baseline for the statewide oil and gas activity index is 100.0 – the TPI figure for Jan. 1995. It noted the TPI hit its most recent cyclical peak of 213.8 in Feb. 2019 and has since fallen more than 37 percent. The graph below shows changes in the TPI since Jan. 1995.

SOURCE: Texas Alliance of Energy Producers

SOURCE: Texas Alliance of Energy Producers

“As these numbers would suggest, the Texas upstream oil and gas economy was already in a state of contraction before the onset of COVID as an economic event in 2020, with the steady decline in 2019,” remarked Ingham. “The COVID impacts beginning in March 2020 are obvious, and the change in the various components of the TPI as well as the index itself are easily measured.”

Based on its TPI analysis for 2020, the Alliance made the following observations:

- On average, monthly posted West Texas Intermediate (WTI) crude oil prices fell by more than 30 percent in 2020 compared to 2019.

- The monthly Baker Hughes (NYSE: BKR) rig count for Texas fell by more than 60 percent in 2020 – from 406 in Dec. 2019 to 155 in Dec. 2020.

- The number of drilling permits issued by the Texas Railroad Commission dropped by 46 percent in 2020 – the lowest level since at least 1960.

- Last year, Texas lost nearly 60,000 direct upstream jobs – making up the majority of the estimated 78,000-job decline since the most recent industry employment peak of more than 228,000 jobs in Dec. 2018.

“The job loss is devastating,” commented Ingham. “In addition, wages were pushed down sharply for those who remained on oil and gas company payrolls. The combined effects of lost jobs and lower industry wages only served to worsen the effects of COVID on the statewide economy, and on local and regional economies with strong ties to oil and gas production.”

In terms of Texas’ crude oil production, the Alliance pointed out the state hit an all-time high of more than 5.4 million barrels per day (bpd) in March 2020 – only to drop nearly 20 percent (1.03 million bpd) by May. Since May, the state’s daily crude oil output has regained nearly 407,000 bpd. At year-end, Texas’ daily oil production stood at an estimated 4.81 million bpd, the organization noted.

The Alliance stated that improvements in upstream indicators, notably the statewide rig count and crude oil prices, translated into a slight employment recovery during the final four months of 2020. It estimates that Texas oil and gas company payrolls grew by approximately 2,300 jobs during the period.

“That the industry is adding jobs is encouraging, pointing to at least somewhat better times ahead in 2021,” concluded Ingham. “The Texas Petro Index is poised to find its cyclical trough, hopefully in the first quarter 2021, and begin to register a long and steady recovery from the ravages of COVID in 2020.”

To contact the author, email mveazey@rigzone.com.

No comments:

Post a Comment