Shell (NYSE: RDS.A) has revealed that it has sold its Duvernay shale light oil position in Alberta, Canada, to Crescent Point Energy Corp for a total consideration of $707 million (C$900 million).

The consideration comprises $550 million in cash and 50 million shares in Crescent Point Energy common stock (TSX: CPG), which are valued at $157 million. The deal is subject to regulatory approvals and is expected to close in April this year.

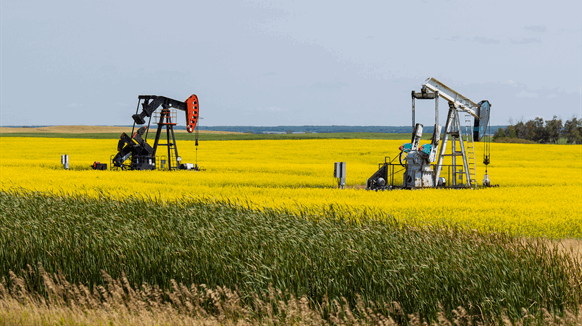

Shell noted that the transaction includes the transfer of approximately 450,000 net acres in the Fox Creek (Kaybob) and Rocky Mountain House (Willesden Green) areas, along with related infrastructure, currently producing around 30,000 barrels of oil equivalent per day from more than 270 wells. Crescent Point Energy will retain the field employees and several technical and commercial roles that support the assets, Shell highlighted.

“Divesting these assets underpins Shell’s effort to focus the Upstream portfolio to deliver cash,” Wael Sawan, Shell’s upstream director, said in a company statement.

“While we believe these assets hold value, the divestment allows us to focus on our core upstream positions like the Permian Basin, with integrated value chains, thereby building a resilient, lower-risk and less complex portfolio,” Sawan added in the statement.

Commenting on the deal, Craig Bryksa, the president and chief executive officer of Crescent Point, said, “we are excited to add the Kaybob Duvernay asset as a strategic core area to our portfolio, as its significant inventory of high-return locations and free cash flow profile provide an attractive and return enhancing opportunity for our shareholders”.

“The acquisition is aligned with our core principles to focus on strategic initiatives that enhance our balance sheet strength and sustainability. It is expected to enhance our free cash flow generation, leverage ratios and ESG profile,” he added.

“The depth of high-return drilling inventory also provides optionality within our capital allocation framework. We view the Kaybob assets as low-risk given that they have been delineated over the past decade and key infrastructure and market access are already in place,” Bryksa went on to say.

Shell, which has been operating in Canada for more than 100 years, stated that it remains committed to the country’s energy future. The company’s footprint in Canada includes a 40 percent interest in LNG Canada, shale gas positions in British Columbia (Groundbirch), shale gas and liquids positions in Alberta (Gold Creek), the Scotford Complex in Alberta, investments in cleaner energy including the first waste-to-low-carbon-fuels plant in Québec, and a retail business with around 1,400 Shell branded sites across Canada.

To contact the author, email andreas.exarheas@rigzone.com

No comments:

Post a Comment