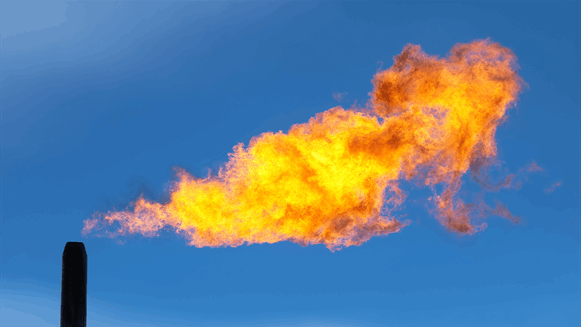

(Bloomberg) -- Texas’s energy regulator is taking an uncharacteristically critical approach toward burning off excess natural gas, a sign that growing pressure from environmentalists and investors to curb the controversial practice is paying off.

The Texas Railroad Commission on Tuesday deferred a series of applications belonging to oil companies including Ovintiv Inc. One such request sought to flare more than $1 million worth of gas because it would be too expensive to build a pipeline to haul the fuel to markets, a claim the agency’s newest member said warranted “further investigation.”

“Flaring is a necessary last resort during an upset, and we have work to do internally at the commission to ensure that we are not approving requests that go beyond that,” Jim Wright, one of three Republican commissioners, said in a statement following the meeting.

The commission is at the center of criticism over the shale industry’s prolific flaring problem given the panel’s record of approving virtually every permit that comes before it. In the past, commissioners have argued that more stringent regulations would have the effect of discouraging some oil production, thereby wasting the state’s natural resources. But a recent report by Rystad Energy found that 40% of future flaring could be avoided at no cost to oil companies.

During Tuesday’s meeting, both Wright and fellow Commissioner Wayne Christian spoke about routine flaring -- industry jargon for burning that isn’t necessitated by pipeline malfunctions or other short-term events.

“For years the commission has been acting like this isn’t an issue, so it’s exciting to see that they now want to end routine flaring,” said Emma Pabst, a climate advocate for Environment Texas. “They’re feeling the heat both from investors and environmentalists alike.”

During flaring, most of the methane -- a potent greenhouse gas -- is eliminated from the gas stream, but the remaining emissions include carbon dioxide. While CO2 tends to be the focus of environmentalists and some investors, the Railroad Commission views the issue as one relating to waste. Recently, the agency noted the need for policies that help make the shale industry more attractive to Wall Street.

“Getting an exception for our flaring rules should not be easy,” Christian said Tuesday. “Staff should ask tougher questions, follow-up questions and generally just dig deeper.”

It’s unclear whether the latest remarks by commissioners signal an actual reduction in flaring permits is in the offing. At a previous meeting, Wright delayed decisions on several BP Plc permit applications, which received approval on Tuesday.

The London-based oil major, which had previously called on the regulator to commit to ending routine flaring, was seeking permits to flare at 121 sites until April 2022. BP said last month that its request for permits was not inconsistent with its long-term plan to reduce flaring.

© 2021 Bloomberg L.P.

No comments:

Post a Comment