(The views and opinions expressed in this article are those of the attributed sources and do not necessarily reflect the position of Rigzone or the author.)

Discipline. Infrastructure. Storage. What do these three words have in common? They will all likely figure prominently this week in the oil and gas markets, according to a trio of Rigzone market observers. To find out how, keep reading for more context.

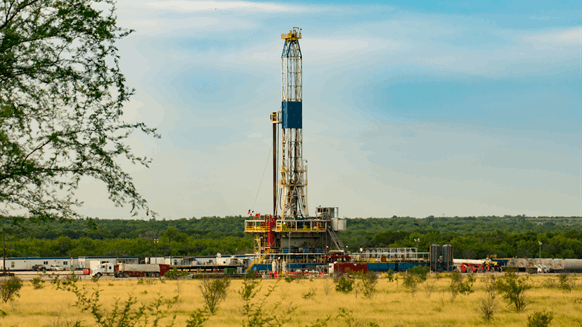

Tom McNulty, Houston-based Principal and Energy Practice leader with Valuescope, Inc.: U.S. production will continue to increase, and it will be measured and efficient. I just spoke to one of my oilfield services clients, down in the Eagle Ford. He is seeing drilling activity to keep leases and to create cash flow. His customers are all exhibiting slower, cautious, and cost-effective discipline in their operations.

Gerrad Heep, Partner-in-Charge, Energy – Audit, Grant Thornton LLP: Watch for recovery in the demand for crude. We are nearing the end of the school year and the beginning of summer vacations. Will new U.S. Centers for Disease Control mask guidance and increasing vaccinations result in significant increases in vehicle and plane travel?

Crude supply merits some attention as well. Just months after the Keystone XL was cancelled, we saw the significant impacts of disruption to an existing interstate pipeline. Look for continued near-term discussion about the need for pipeline infrastructure.

Mark Le Dain, vice president of strategy with the oil and gas data firm Validere: As we continue to advance into summer it's going to become clear that natural gas storage is not building at a rate required for next winter. This showed up in some of the recent price action, but it is still not bringing on significant supply and part of that is a fundamental resource constraint for many gas producers and incredible discipline by others. Even Tourmaline (TSX: TOU), potentially best-in-class in North America, could turn on an incredible amount of production but has continued to emphasize that where possible they will use their cash to add volume through acquisitions and not by increasing total supply to the market. This continues to play out through their acquisitions updates as recently as this past week. Gas producers seem to be holding the line – some by accident as they chase higher liquids returns, but still the same impact in the numbers.

To contact the author, email mveazey@rigzone.com.

No comments:

Post a Comment